Hi everyone,

There’s a lot of tech M&A to discuss this week. We have QXO and Brad Jacobs’ open letter to Beacon, B2B marketplace M&A activity from Q4, and Enable’s recent acquisition.

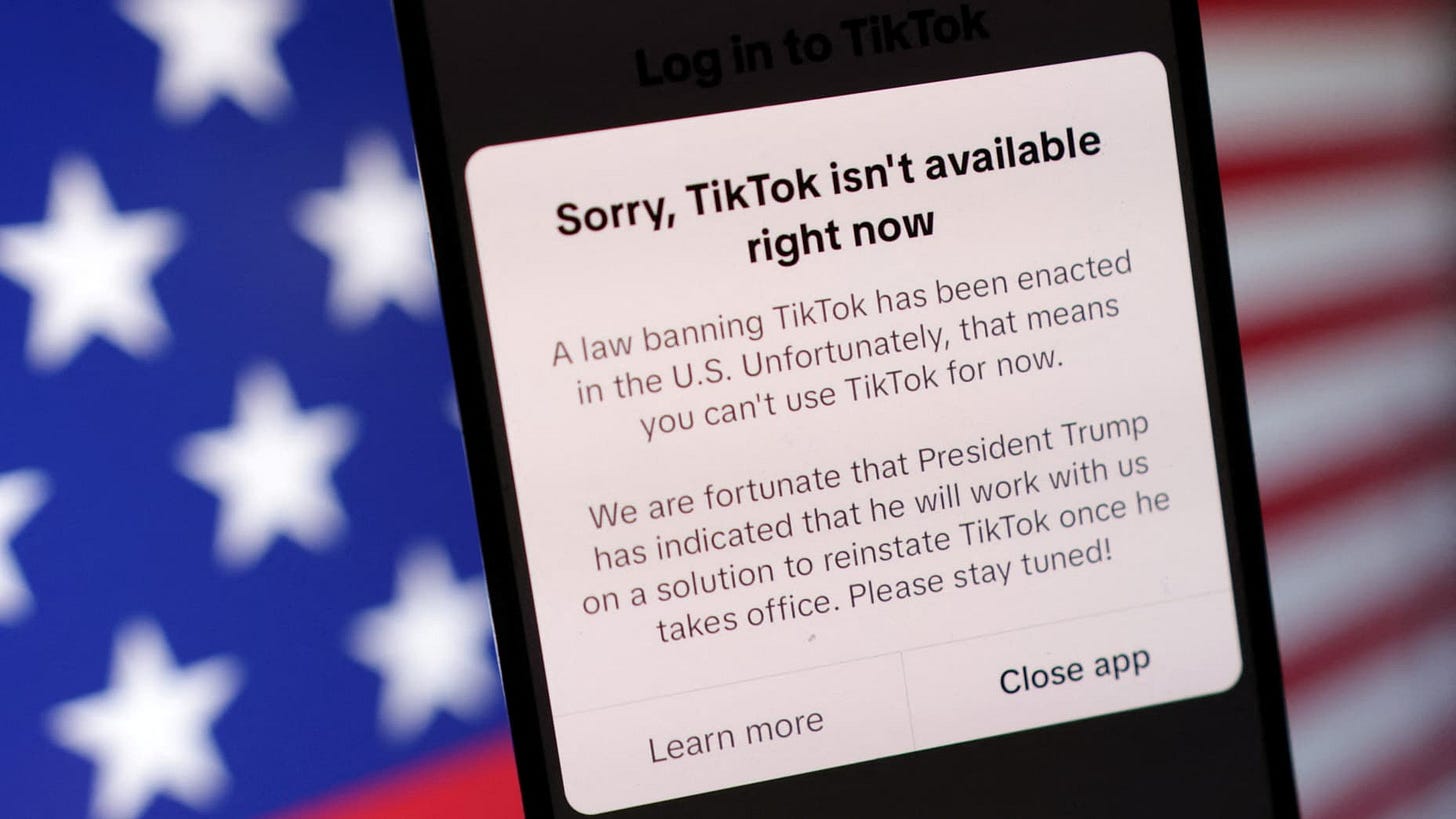

But first, a note on TikTok and their forced M&A…

TikTok went dark for about 13 hours today after President Trump gave them assurances to turn back on their service. Trump has signaled he’d like a JV created where 50% of TikTok is owned by an American company.

Back in April 2024, congress passed the “Protecting Americans from Foreign Adversary Controlled Applications Act” in April 2024. The bill gives the President sole authority to designate a software company as “foreign adversary controlled.” I wish the bill was more narrow and specific to just TikTok – as opposed to giving the government even more power and wide-ranging authority to theoretically ban any foreign software company from a hostile country.

I think the TikTok ban (or the threat of a ban) is a good thing, but unfortunately the bill provides too much power to the President.

China is not a friend of the US. And, they don’t allow Facebook or Google to operate in China, so I’m not losing any sleep over TikTok’s gripe. The ban is conditional in the sense that Bytedance (owner of TikTok) and China (owner of Bytedance) have the option to sell TikTok to a US company or be banned. So, we’ll see if they agree to Trump’s suggestion for a 50/50 JV. And, if they don’t, good riddance!

M&A Consolidation amongst Marketplaces

Last quarter, we saw four M&A transactions of marketplaces – two B2B marketplaces and two B2C marketplaces. The two B2B marketplace transactions were mergers – signaling a consolidation in the industry and another sign that Phase 1 of B2B Marketplaces is running its course. Meanwhile, Phase 2 of B2B Marketplaces has kicked into high gear with ServiceTitan’s IPO last quarter.

B2B Marketplaces

B2C Marketplaces

Each of these businesses has its own backstory and rationale for the M&A transaction. However, notice that the B2B marketplace transactions were mergers with their direct competitor – whereas, the B2C marketplaces were acquired by a strategic.

As we’ve discussed previously, the next version of B2B Marketplaces are gaining traction and quickly. The main difference between these new B2B marketplaces is that they have an integrated, end-to-end digital experience with their business customers. The 2.0 version of B2B Marketplaces started as SaaS companies serving the customer of B2B distribution, whereas the original wave of B2B Marketplaces generally started as a marketplace from the get-go and have a non-integrated interaction model.

ServiceTitan, part of the 2nd wave of B2B marketplaces, started in 2007 as a SaaS tool for contractors and is now evolving into a B2B marketplace that is integrating with B2B distributors to facilitate procurement through the ServiceTitan app. These SaaS tools have tremendous lock-in with the business customer because they help the business run their day-to-day operations. As a result, the procurement experience is “integrated” into the existing daily workflows.

QXO Becomes an Activist Investor

If you haven’t read the full letter from Brad Jacobs to the Chairman of Beacon, here it is.

Beacon quickly responded with a letter that says pretty clearly “no”.

The interesting thing is that QXO never increased the price of their offer since the initial overture was made in November ’24. It seems like QXO wasn’t getting anywhere with Beacon and decided to let the negotiation spill out into the open – curious strategy. And, presumably a sign of an upcoming tender offer – where QXO would try acquire control by going direct to the shareholders.

It reminds me of the kind of activist tactics of a Ron Perelman or Elliott Management, but in B2B Distribution.

QXO’s offer is for $124.25/share which you can see is a material premium to existing shareholders. Back in October, prior to the news leaking about QXO’s interest, the share price peaked at about $96/share.