Hi everyone,

It’s official – ServiceTitan IPO’s tomorrow!

$TTAN is going public tomorrow December 12th on the Nasdaq at an expected $6B valuation, between $65-67/share. This is below the originally rumored $8B valuation. But it’s an increase in the last few days from $5B after receiving strong investor interest on their roadshow.

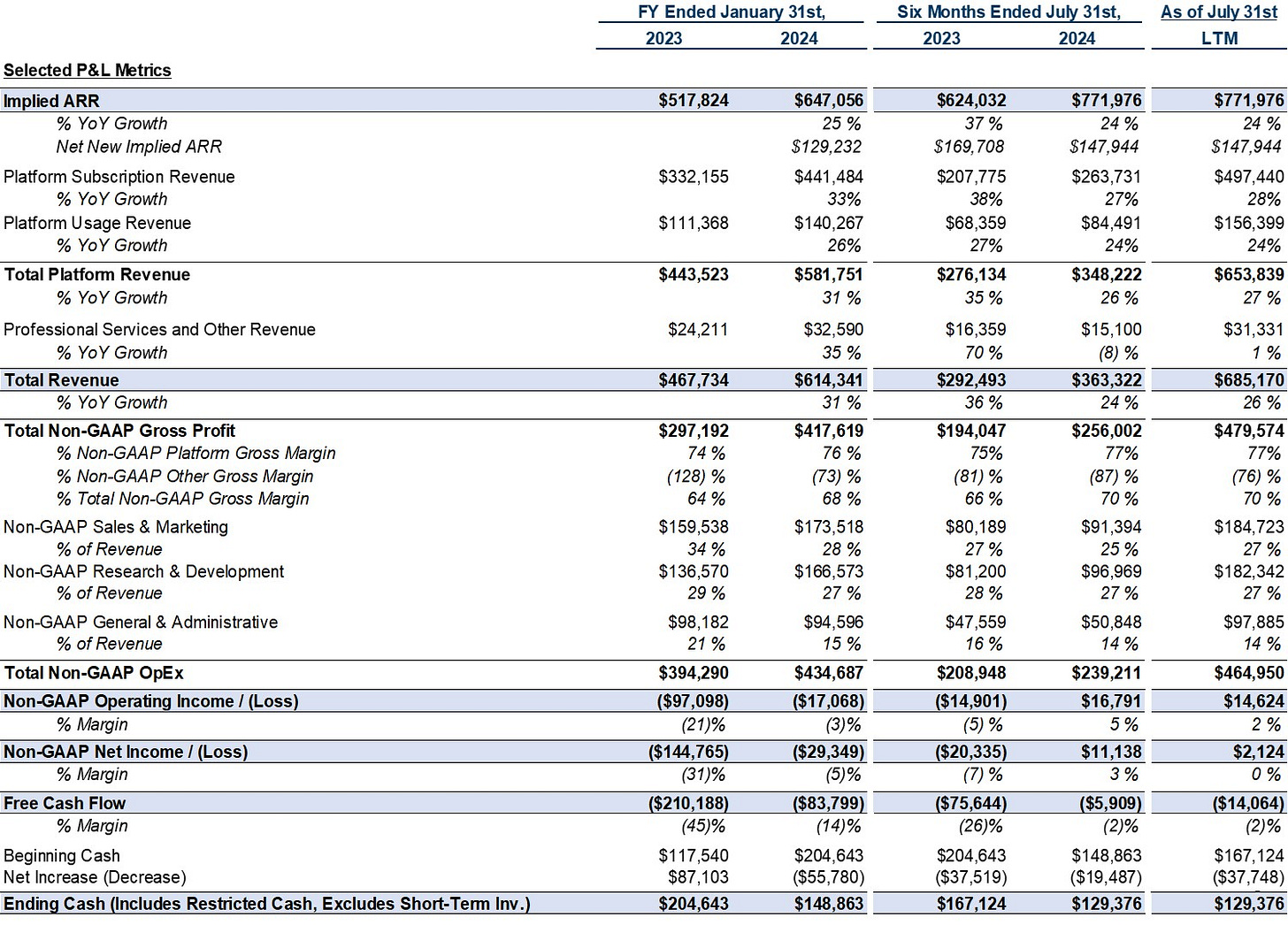

Here’s the headline stats:

$550M ARR

$200M in annualized payment processing and usage revenue

$6B valuation.

8X blended ARR valuation (including usage revenue in the ARR calculation)

$575M estimated IPO proceeds

$310 to buy out preferred equity shareholders (the “true up”, more on this below)

$265M net cash proceeds to $TTAN

Other Key Data Points:

Profitable on a Non-GAAP basis

($200M) GAAP loss

$250M cash & working capital, prior to IPO

Here’s a link to the full S1.

What is ServiceTitan?

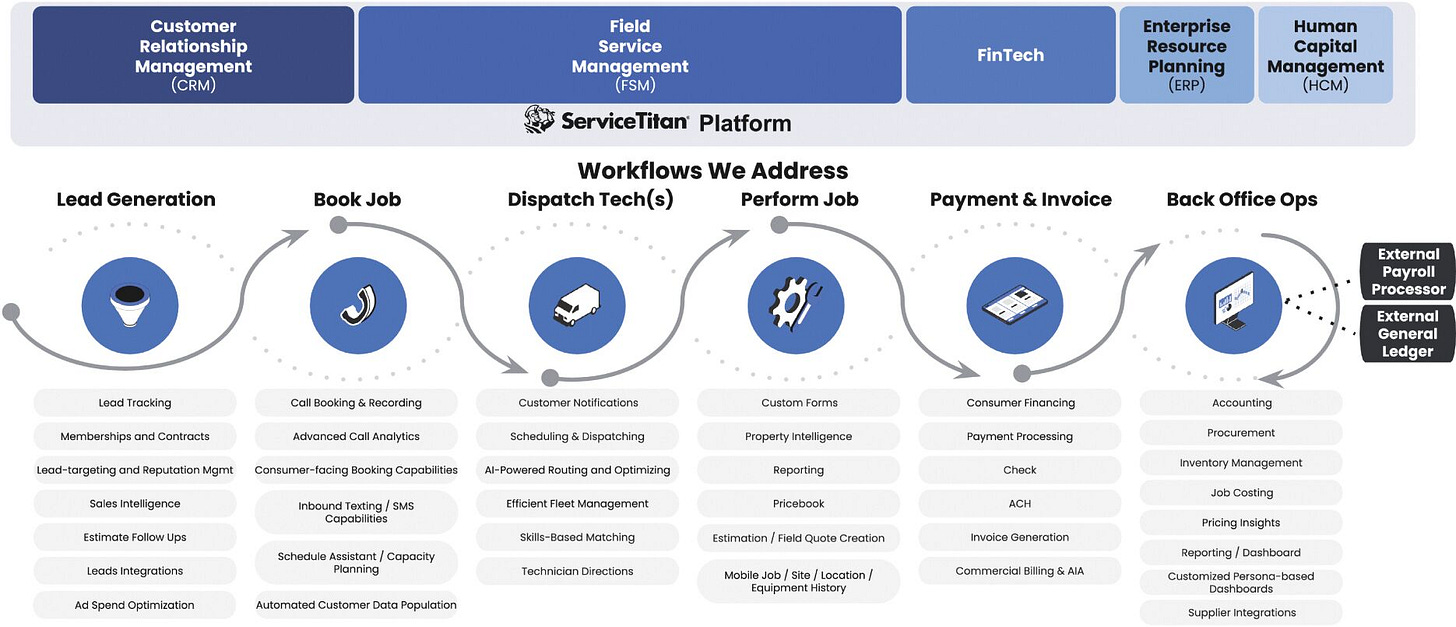

ServiceTitan is the operating system for the residential trade contractor. Whether you're an electrician, HVAC technician, plumber, or garage door repairman – it’s the cloud-based ERP of the small, residential trade contractors. And, now ServiceTitan is expanding into other trade verticals and working with larger, more commercial contractors. Think of it as an ERP, FSM, CRM, HCM – everything a trade contractor needs to run their business.

What will they do with the cash? (And should you invest?)

The $310M True Up

The $310M true up is from the non-convertible preferred equity that ServiceTitan raised during 2021 and 2022. In March ‘21, they raised $500M at an $8B valuation. Then, in June ‘21, another $200M at a $9.3B pre-money valuation. Then again in 2022, another $365M at a $7.23B pre-money valuation. All of those valuations are higher than their IPO valuation of $6B. These preferred equity investors have liquidation preferences. However, ServiceTitan should be able to issue additional shares to make the preferred equity shareholders whole – they shouldn’t have to come out of pocket additional cash normally. But, ServiceTitan had some structured and unique investment vehicles back in 2021 and 2022.

As TechCrunch highlighted, ServiceTitan’s 2022 fundraise came with special ratchet terms. “The company disclosed that it plans to use a big chunk of the money — about $311 million — to buy back all the shares of its nonconvertible preferred stock, at $1,000 a share, which is the price these investors paid.

Plus, it will pay those stockholders any unpaid dividends per share. The investors are, according to these documents, Saturn FD Holdings, LP, and Coatue Tactical Solutions PS. The company was on the hook for annual 10% dividends for five years and 15% for the sixth for these shares.”

For the six months ending July 31, 2024, ServiceTitan booked a ($27M) charge attributed to the non-convertible preferred equity. So, if nothing else, this IPO lets them save $50M+ a year in effectively interest expense.

M&A of course!

Expansion into roofing.