Amazon Business: Bull or Bear?

We play out both sides of the argument for or against Amazon Business

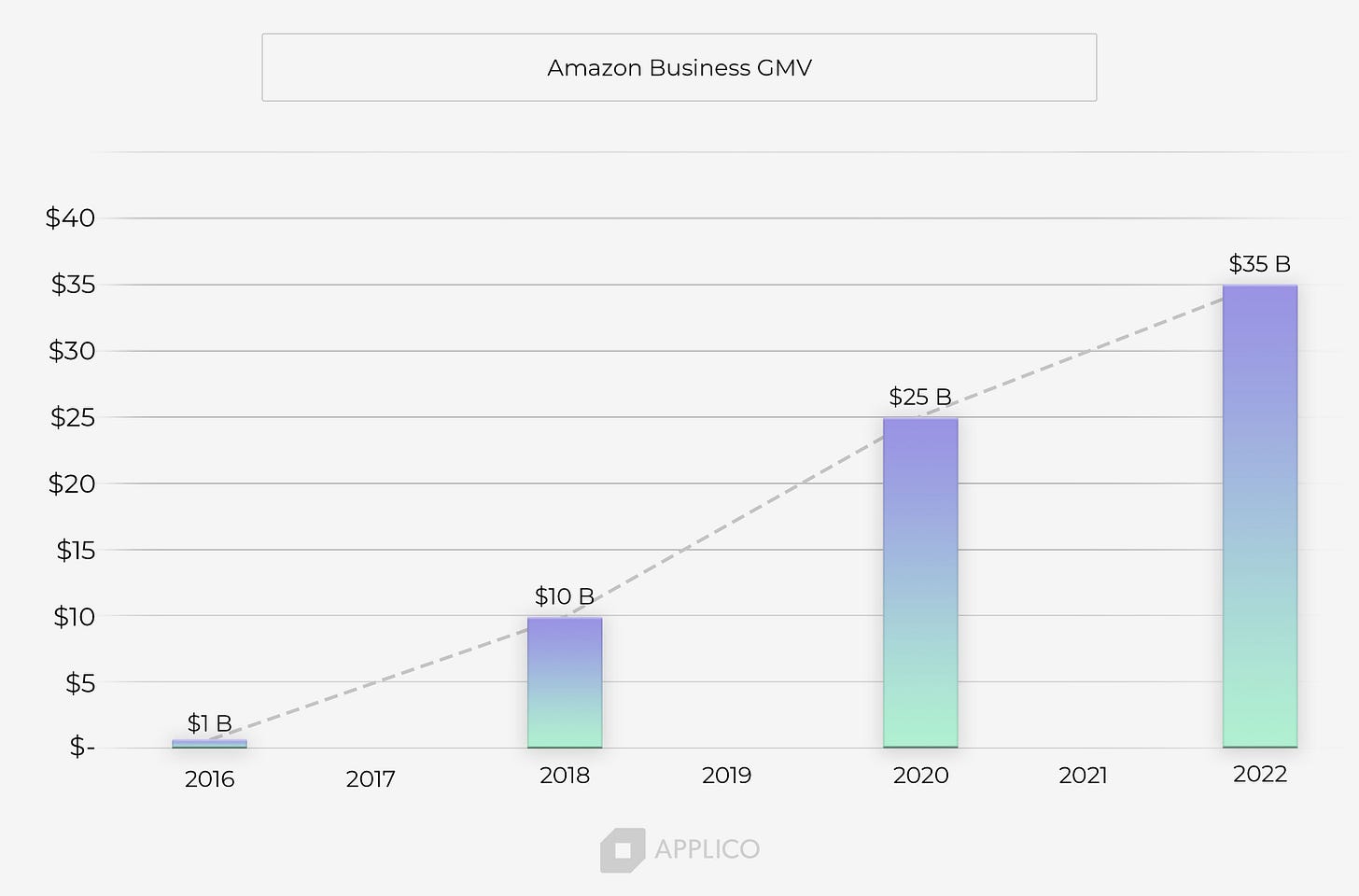

Amazon Business, the e-commerce giant's dedicated B2B platform, recently achieved a significant milestone by surpassing $35 billion in Gross Merchandise Value (GMV). Making it the 4th largest B2B distributor and/or marketplace behind the big 3 medical distributors. This milestone has sparked discussions about its potential impact on B2B distributors. This week, we take a look at both sides of the argument.

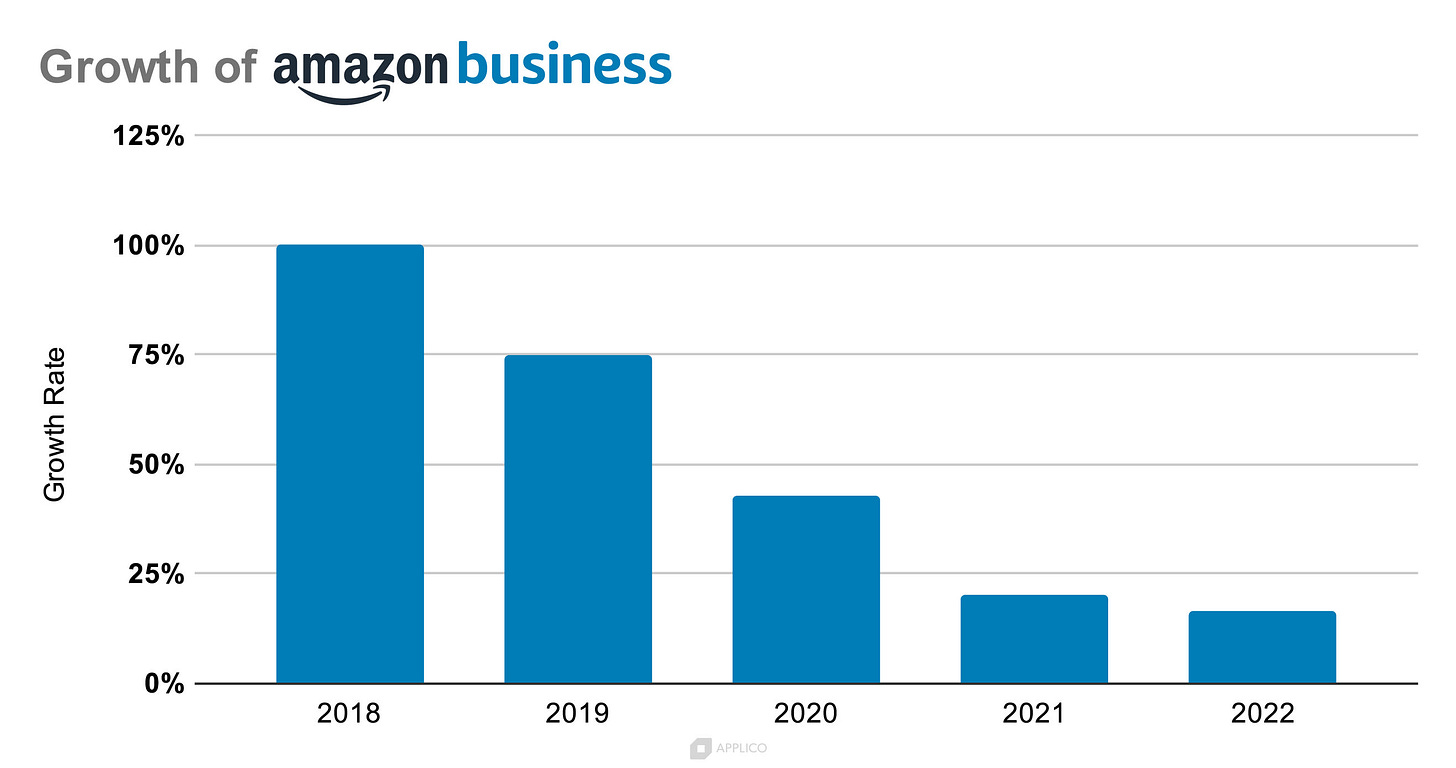

The Bear view is that Amazon is a generalist marketplace whose growth is plateauing. Most of Amazon’s recent B2B growth is from expansion into Europe, and the actual growth in the US is much lower. Further, Amazon Business is reclassifying spend from Amazon consumers and small businesses for office supplies and run of the mill purchasing - which is a far cry from proper B2B distribution volumes.

The Bull case is that Amazon Business is one of the brightest spots of growth for Amazon - and they are going to reinvest heavily. Amazon marketplace overall growth has slowed to 9%, whereas Amazon Business is just getting started in a $6-8 trillion market just in the US. Amazon Business has already started to shift from being a horizontal, generalist marketplace into a vertical specific player as seen in healthcare, government and education. Amazon will continue to use its fortunes to help Amazon Business go deeper into specific verticals to fuel continued growth.

Below, we take some of the biggest questions distributors have about Amazon Business and explore these two viewpoints. Which side sounds like it’s making the most sense to you?

Amazon Business Has Hit $35B in GMV, Should Distributors be Worried?

The Bear:

Reclassified B2C Customers:

One crucial aspect that has contributed to Amazon Business's substantial growth is the reclassification of B2C customers as B2B users. Many customers have been conducting business transactions on Amazon's consumer platform for years, and Amazon Business has now shifted these small business customers to its B2B platform. By classifying them accordingly, Amazon boosts its reported growth numbers. The company has acknowledged this crossover, stating, "Amazon has long known that businesses and organizations were shopping for office supplies and other goods in bulk on its store."

Expansion in the EU:

Another significant driver behind Amazon Business's soaring GMV is its expansion in the European Union. It is currently operating in 5 countries in the EU. As Amazon Business rolls out to more countries, it is reclassifying B2C spend as B2B, per the above point. And, the new volumes are purely additive - helping them boost their YoY growth numbers. It serves over 50% of FTSE 100 companies in the UK, counts 16 of the 20 largest universities in the UK among its customers, and has established strong relationships with major hospitals and corporations in Germany, France, Italy, and Spain.

The Strength of Traditional Distributors:

Amazon Business can skim some volumes off the top, but to penetrate more deeply into a vertical, it needs to invest significant capital in infrastructure and seed its marketplace with 1P inventory. Meaning, Amazon Business needs to expand its balance sheet to buy more inventory in specific verticals to lure business customers onto the platform. Distributors can leverage their existing networks, personalized service, and deep industry knowledge to retain loyal customers who value long-term partnerships and trust, making it unlikely for Amazon's growth alone to overshadow the value provided by established distributors.

The Bull:

eProcurement Integrations: Breaking From The Normal Amazon Model