Supply Chain by Amazon: A Direct Attack at Distribution?

Detailed breakdown and pricing analysis

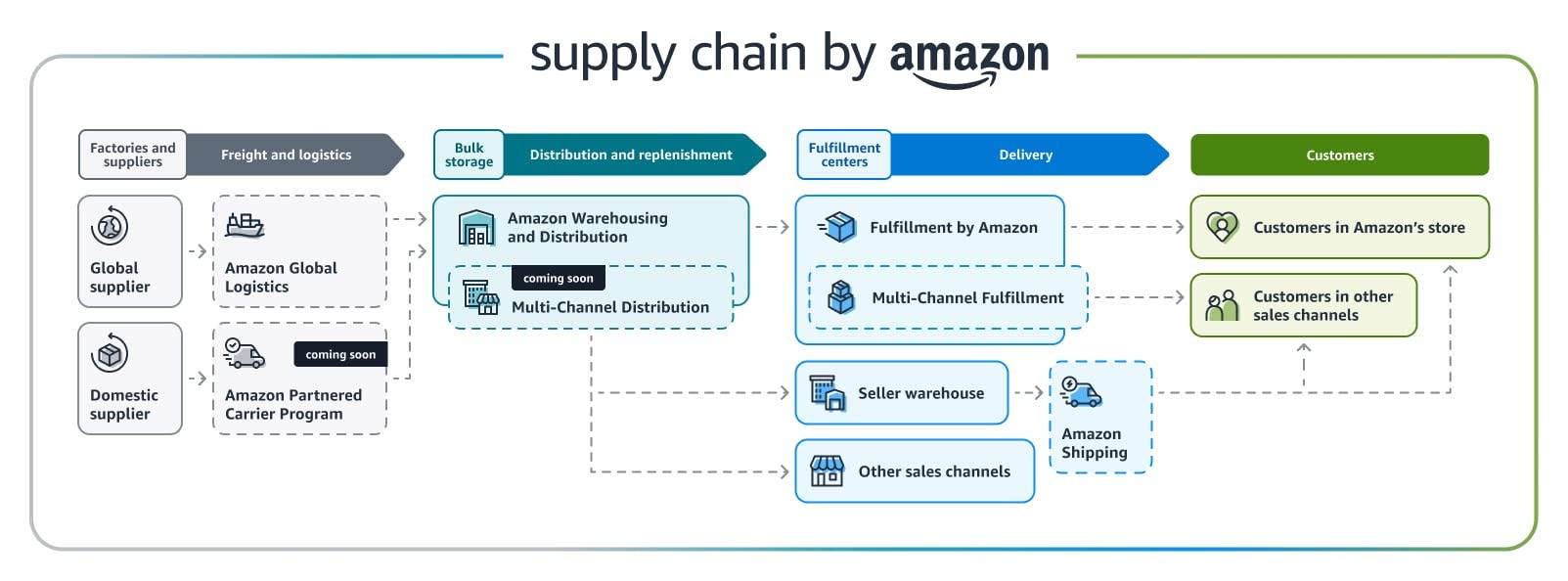

As part of its annual Accelerate conference last week, Amazon announced Supply Chain by Amazon. Supply Chain by Amazon is a new offering that helps Amazon capture deliveries to offline retail - which still accounts for over 84% of all retail purchases. The chart below shows that eCommerce retail in the US just crossed the 15% threshold in Q1 ‘23.

This service welcomes non-Amazon sales channels, continuing an atypical trend within Amazon’s B2B strategy that we first pointed out as part of our analysis of Amazon’s ERP integrations.

Amazon is inviting any supplier into its logistics ecosystem—marketplace and eCommerce orders are managed through Fulfillment By Amazon (FBA), while offline orders are handled with Amazon Multi-Channel Fulfillment (MCF).

Supply Chain by Amazon can be broken down into three distinct segments:

The first step comprises services dedicated to receiving goods from global or domestic manufacturers/suppliers. This facet ensures a seamless flow of inventory into the Amazon ecosystem.

The second segment involves a comprehensive warehousing offering, aptly named Amazon Warehousing Distribution (AWD).

The last segment is fulfillment, previously limited to Amazon's own Fulfillment by Amazon (FBA) program, this layer will now be able to serve various sales channels, including physical stores and a retailer’s DC. This offering enables Amazon's distribution capabilities to service the 85% of offline retail purchases.

The ability for all sales channels to be serviced from a singular optimized bulk inventory pool via Multi-Channel Distribution is a direct threat to 3PLs and carriers.

The end-to-end flow of Supply Chain by Amazon looks like this: