Strategic Tech M&A in Distribution

It's not just distributors who are buying up B2B tech!

Those of you who have read our recent reports on direct distributor tech M&A and investments have likely noticed little to no activity from distributors as of late. But while distributors sit idly by, strategics still account for the large majority of tech M&A. In this week’s issue, we breakdown a recent tech M&A report from CB Insights and compare and contrast that with tech deals in distribution.

Q2 Aggregate Valuations Up 📈, Deals Decline 📉

In Q2 and Q1'23, global tech M&A resembled 2019 numbers. Valuations were actually higher, on average, in 2019. This is a great sign that tech valuations are starting to return to more normal levels - all it took was record inflation and interest rates!

Interestingly, tech monopoly M&A activity reached an 18-quarter low, with only one deal in Q2. For B2B distributors closely monitoring Amazon Business, hopefully FTC commissioner Lina Khan sticks to her guns and files the much anticipated lawsuit against Amazon’s product marketplace monopoly.

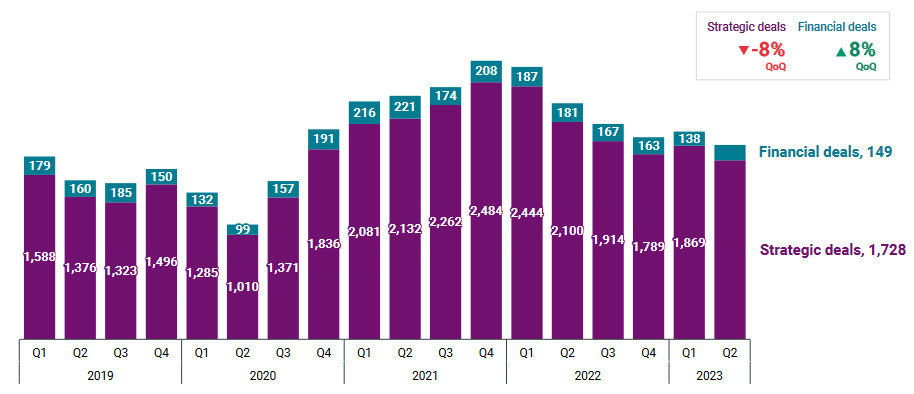

Strategics Bulk of M&A Tech Deals ♟

Strategic tech M&A deal count saw a 18% YoY decline, but a 25% increase compared to Q2 ‘2019. The numbers are pretty shocking with strategics accounting for a 92% share of tech M&A transactions.

For large M&A transactions (deals of $100mm+) in 2023, PEs average a more significant 22% share, indicating that when it comes to larger price tags, private equity isn’t shying away.

Private Equity’s Eye on B2B Distribution Tech 👁

As traditional distributors face the need for digital transformation and optimization, PE firms are increasingly viewing B2B tech solutions as lucrative opportunities for investment. PE investors are different than VCs. They want profits, not losses and are OK with slower growth rates. PE likes B2B distribution tech. These companies may not have the sexiest technology, but it’s sticky - hard to replace and profitable with moderate growth. Below we’ve profiled three examples of PE deals in B2B technology as well as some notable strategic acquisitions by distribution.