Hi team,

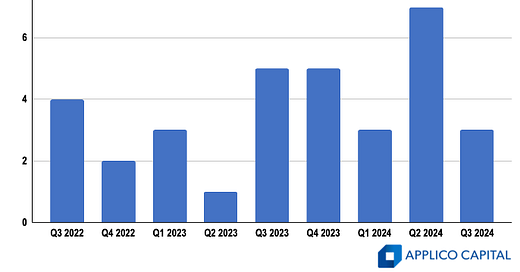

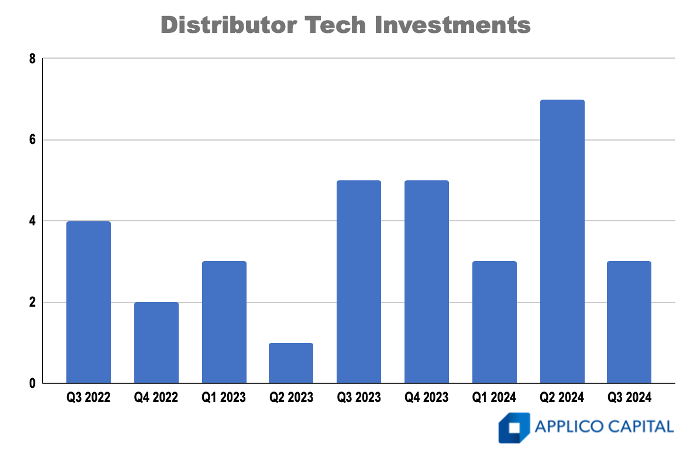

Q2 was too good to be true with an all-time record of 7 tech investments made by B2B distributors! Unfortunately, in Q3, our numbers fell to 2 tech investments and 1 tech acquisition. We also had 1 hardtech investment in a company developing a green climate-friendly cement.

As we dive into details on the transactions, one thing is clear: Superseed Ventures is putting the B2B distribution tech investment industry on its back. We feature a profile of Superseed and their corporate entity, Reece, below.

As a bright spot, if we counted the number of B2B distributor strategics who invested in Applico Capital’s second close last quarter, our numbers would go way up! More on that below too.

Who is Superseed Ventures?

Superseed Ventures is the CVC of Reece, one of the leading HVAC and Plumbing distributors in both Australia and the US. Reece bought Morsco in 2018 in a $1.4B transaction and have continued to bolt-on additional subsidiaries over the past 6 years – making it a major player in the US.

We had the pleasure of interviewing one of the Managing Partners from Superseed, Phil Sondhu, at the end of last year.

With a total of 14 tech investments since inception a few years ago, Superseed is investing in “TradeTech transforming trade businesses and the built world.”

Applico Capital Completes Second Close

Last quarter, we were fortunate to have conducted our second and final closing in our inaugural VC fund – investing in technology to help the $8 trillion B2B distribution industry.

We’re honored to have more than 10 multi-billion dollar B2B distributor strategics as LPs and to welcome some of the biggest names in B2B distribution into the fund. Our distributor strategics span across all the major verticals including building materials, food, healthcare, and industrial.

Since launching the fund last year, we’re proud to have made 5 investments with some of the best founders in the business.

Three Tech Investments in Q3 ‘24

A precipitous drop in minority tech investment activity left us with 3 investments this quarter, including one investment in Australia and both minority investments made by Superseed!

That’s alright though – we’ll bounce back in Q4 and finish the year strong.

Tech M&A Continues Trend

Wesco acquired another company this past quarter - with two back-to-back quarters with tech transactions. We highlighted their acquisition of entroCIM in our Q2 update and they weren’t done. Their latest acquisition of Storeroom Logix is timely given Amazon’s announcement to move into VMI. More on this acquisition below.

Superseed Invests in Recurrency

Recurrency, an Applico Capital portfolio company, received an undisclosed sum of investment from Superseed this past quarter. Separate from this investment, Recurrency has raised over $25M from the likes of Bessemer, Y Combinator, Contrary and other illustrious VCs.

We initially invested in Recurrency at the end of last year and it’s been great to witness the company’s ability to reinvent demand planning and purchasing software in B2B distribution. Many distributors we talk to say, “I make money when I buy materials, not when I sell them.”

It seems counter intuitive at first blush; however, the more you think about it, the more it makes sense. If distributors can get smarter about what they buy, when they buy it, and for how much – their sales teams can do the job and sell the materials.

Two examples to illustrate this point: Inventory turns and internal transfers.

Measuring your inventory turns is a great way to measure the proficiency of your distribution organization. How fast your business turns its inventory is a key metric and directly correlated to how well you procure your COGS. Can new, modern demand planning and procurement software help improve your inventory turns?

Internal transfers. Should you buy more inventory or replenish from a nearby DC? This seems like a simple, logical question to ask yourself before buying more inventory from a supplier. Unfortunately, with legacy software, checking on internal transfer availabilities and then executing an internal transfer is not made easy – and, as a result, is often overlooked by busy procurement teams with a laundry list of competing priorities.

Support us by becoming a premium subscriber to read about the other 3 minority investments and 1 tech acquisition in Q3!