Hi everyone,

Is the VC winter thawing in Enterprise SaaS? Q2’s tech investment data seems to indicate yes, especially within Distribution Tech.

Overall VC Funding Increases

According to the Pitchbook/NVCA report, $55.6B was invested in tech startups in the US in Q2 2024. The roughly 30% QoQ increase was certainly influenced by a couple big deals in the quarter; however, estimated deal count was also the highest since Q2 2022.

Distribution Tech Up and to the Right

Deal count and overall funding levels were off the charts in Q2 for our Distribution Tech Index - a tracker of over 1,000 tech companies in and around B2B Distribution Technology. This follows a very sluggish Q1 for distribution tech; however, Q2’s bounce back more than makes up for the slow start to the year.

Given the large decline in Q1 ‘24, Distribution Tech had some catching up to do. Enterprise SaaS has still, on a relative basis, had more total funding growth over the past few quarters. That said, Q2 was a promising step in the right direction to recognize the value of tech startups in B2B Distribution.

When compared to the overall VC market, both Enterprise SaaS and Distribution Tech have outpaced total relative funding growth in the past few quarters. Download the report for more comparisons and analysis!

Enterprise SaaS Continues Later Stage Trend

Enterprise SaaS funding had a nice QoQ increase in total funding - at over 50% QoQ, but deal count fell for a second consecutive quarter. Indicating investors are continuing to double down on later stage companies.

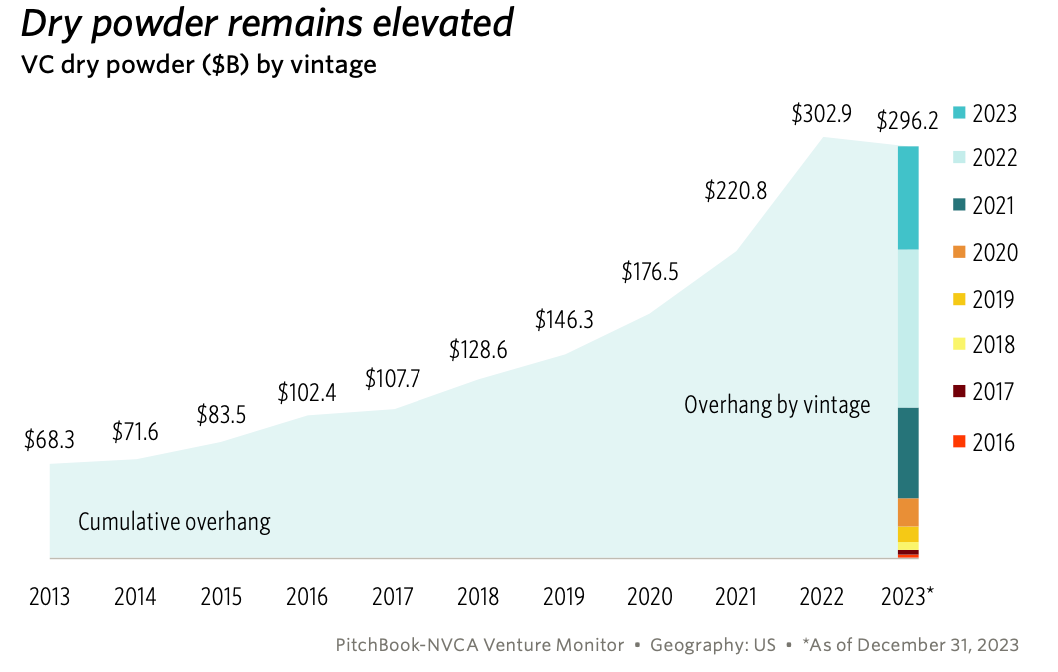

When Will the Dry Powder Dam Break?

VC Winter brings big dry powder. VC dry powder continues to sit at all-time highs. Venture funds have a limited investment period to make initial investments. And, as you’ll see below, the 2021 and 2022 vintage VC funds still have a relatively large amount of dry powder.

Download the full Q2 2024 Report Now!

-for premium subscribers