Hi everyone,

Following up on last week’s analysis of B2B distributor tech investments in Q1, we continue this week with our analysis of the overall tech startup and venture market.

We read through the hundreds of pages of analysis – so you don’t have to. Here are our top takeaways on broader Q1 venture trends in the US. Hint: this post ends on a positive note – so make sure to read the last graph (and become a premium subscriber)!

Next week, we’ll compare our B2B Distribution Tech Index against the overall venture market and Enterprise SaaS.

Investor Leverage at Record Levels

Measuring startup friendly versus investor friendly on the y-axis, all stages of venture investors are enjoying the most friendly investing climate in many years. Pitchbook performs regular surveys of venture investors across the spectrum – measuring valuation, investor rights and specific terms, and overall competition to get into desired deals.

Has investor leverage plateaued? Could it go higher? In a year with unabated inflation, high interest rates, and a presidential election, 2024 isn’t looking much better for startup fundraising.

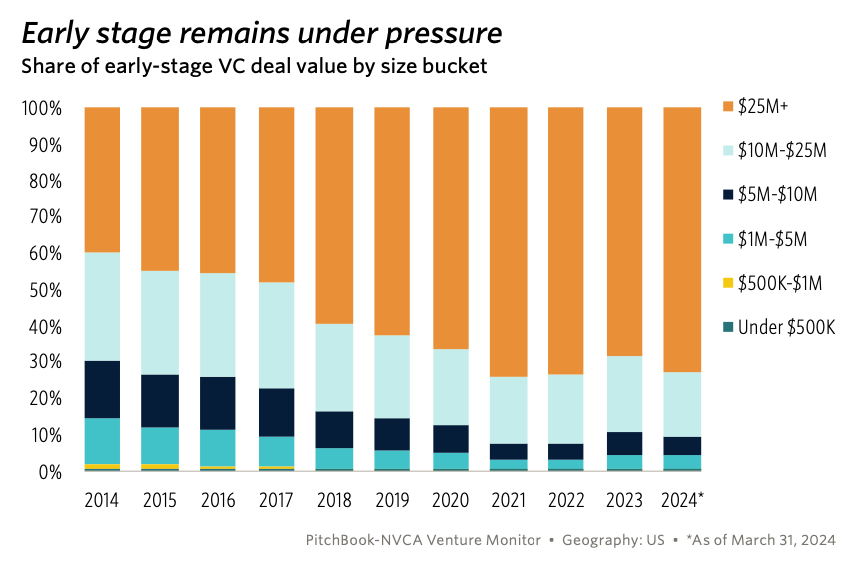

Early Stage is Under Fire

Nearly 70% of early stage VC deals in Q1 were for fundraises of $25M+. And, nearly 90% of early stage was $10M+. In general, we’re seeing a flight to safety with investors. Kind of like in early-mid 2020, when investors heavily favored later stage venture deals.

Investors Will Still Pay for the Best

The criteria to be considered the “best” has become even more heightened with fewer deals and less capital being invested. However, the median valuation has risen across all stages. Early stage VC had the smallest increase, but all the other stages had a 30-50% increase in median valuation.

Enterprise SaaS Continues Downward Trend

Deal count continues to decline across all stages for enterprise SaaS. Overall funding amount remains flat over the past few quarters, but is down by almost 35% from Q1 ’23.