Our Take on The State of Distribution Tech - Q2 2023 🧠

Analysis on the Report from Last Week

Last week, we released the Q2 2023 State of Distribution Tech report—an unparalleled resource tracking tech investing in B2B distribution related startups. This week we dive into further analysis on the report and broader tech investment trends:

- Our key takeaways from Q2’s State of Distribution Tech report. 📊

-evaluating tech investing when compared to pre-Covid times, c. 2019 (a long, long time ago!). 🕰

-Highlighting Amazon’s two tech investments in Q2 and how they debuted in our top distribution tech investors list. ⛔

-VC fundraising inflows - a key indicator of where the market is headed. 🐌

Let’s dive in!

B2B Distribution Tech is Resilient! 💵

My favorite section of the Q2 report is the comparison against other verticals of technology companies and how much funding they are receiving on page 6 + 7. The B2B Distribution Tech and Enterprise SaaS verticals are the only two that didn’t decrease their QoQ funding in Q2 ‘23. Enterprise SaaS covers a lot of different types of technology, a lot of which has nothing to do with B2B distribution - for example, there’s a lot of enterprise SaaS in the financial services and insurance industries, or in the automotive and cybersecurity industries. So, both these categories - which are both not consumer facing - bucked the trend and increased their respective funding to startups.

QoQ Total Funding Percent Change:

Comparing Enterprise SaaS and B2B Distribution also reveals some insights. Enterprise SaaS saw more overall dollars invested but in fewer deals, highlighting an emphasis on later stage investing. We saw a similar trend in late 2020 - when investors were scared because of Covid, there was a flight to safety mentality where later stage tech companies were considered safer and more reliable - therefore, became more desirable and investors concentrated their investments accordingly.

On the other hand, Distribution Tech investments maintained a steady deal count while also increasing funding. This trend in Distribution Tech is indicative of earlier stage tech companies also receiving funding and the investments to be more evenly spread out across stages when compared to Enterprise SaaS.

QoQ Deal Count Percent Change:

Amazon Buffaloed Its Way Onto Our Top B2B Investors Chart 🐃

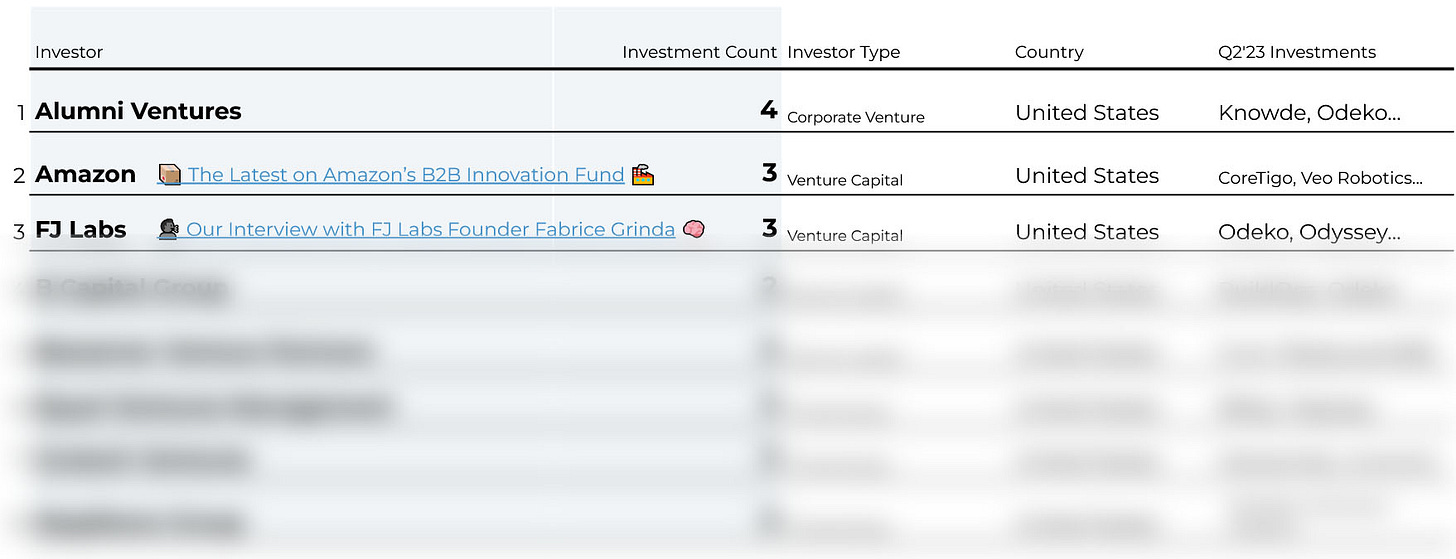

In a notable feat, one which many people thought not possible a few months ago, Amazon has secured a top 3 spot in our top Distribution Tech investors list for the first time. Many thought that the Amazon Industrial Fund had shut down after key leadership exited from Amazon - but in our previous newsletter, we correctly pointed out that this was far from the case.

We’ve covered Amazon’s B2B investing in past editions and below are the two latest B2B relevant investments by Amazon. One a part of Amazon Industrial Innovation Fund and the other just a straight investment from Amazon.com.