Let's build again!

Manufacturing’s resurgence brings multiple expansion

I was at an investor conference last week with all different types of investors – hedge fund managers, growth funds, institutional investors, family offices … and a lot of PE buyers.

Unfortunately, globalization and our over reliance on China has gutted many middle class manufacturing jobs in America the past few decades. Manufacturing employment peaked in 1990 and has steadily declined until about 2010. So, I was overjoyed to hear that a lot of the private equity investors were focused on buying manufacturing businesses. An October 2023 survey found that:

69 percent of U.S. manufacturers have started to reshore and 93 percent plan to increase their pace of reshoring.

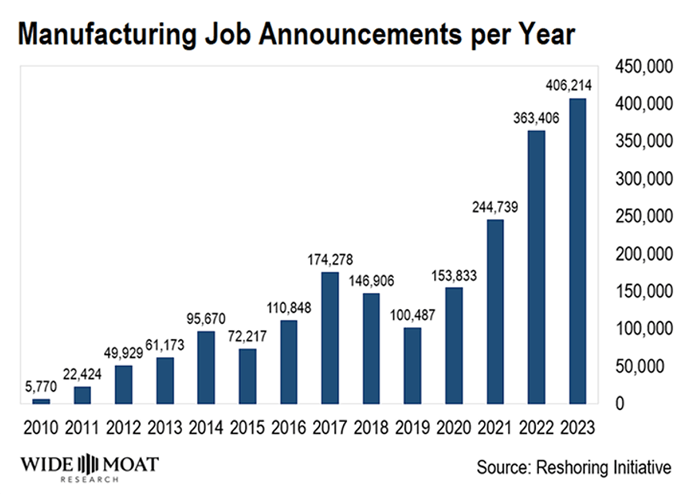

Manufacturing employment has been slowly gaining in the past 10 years. And now, is starting to see a sharp uplift.

These PE buyers are paying much higher multiples than a distributer fetches. Many are paying 13+ earnings multiples for small manufacturing companies with $5M EBITDA. Even the distressed buyers are paying premiums to turn-around defunct manufacturing businesses.

When I talked with these investors about B2B distribution, the common misconception was that distributors are just box movers. What they didn’t understand is that most distributors are actually providing a lot of services in companion to material delivery. And, more and more of those services are some form of manufacturing.

Speed and Convenience from Manufactured Distribution

The rug really tied the room together - the “Dude”

Investors who are new to distribution tend to overestimate the pricing sensitivity of B2B customers. Yes, price is a factor – but in many circumstances, it’s not the deciding factor. When your customer is a business, reliability and convenience frequently trump the cheapest provider. In some distribution industries, the cost of materials is directly passed onto the customer. And, with a markup!

Apple’s motto of “it just works” applies to a lot of the value proposition associated with procuring from a B2B distributor. The services provided by the distributor is the glue that brings together a variety of materials, with different requirements into a seamless customer delivery experience. In the words of “the Dude”… the services are the rug that really ties the room together.

In my experiences with distributors, more and more of the services are taking the form of manufacturing activities.

There are “light manufacturing” services where some kind of cutting, assembly or polish/finish needs to be applied to the materials before delivery. This is prevalent across a variety of verticals like:

Building materials

Industrial materials

Chemicals

Electrical

Oil & Gas

Then, there are full manufacturing services that distributors vertically integrate and replace the manufacturer all together. We’re seeing this in industries where these trends are on the rise:

Growing need for Contract manufacturing

3D printing and additive manufacturing

On-demand and just-in-time replacement parts

The rise of MES technology in Distribution

MES stands for manufacturing execution system. Kind of like an ERP for a manufacturer. It tracks your inventory, input costs and dispatches and prioritizes jobs on the shop floor. For industrial distributors, many of their customers will be using MES software. I recently spoke with the CEO of an MES software company with the thinking that his company and my industrial distributor shared a lot of customers and could explore a partnership. His response surprised me – he wanted to approach my industrial distributor to become a customer, not a partner!

He saw this industrial distributor getting into the service of manufacturing and thought they could use his MES software to better run their manufacturing business. He looked at my industrial distributor – not as a distributor, but as a manufacturer.

This convergence between distribution and manufacturing creates a lot of complexity – not just from an IT standpoint (ERPs and MES, while similar, are also quite different); but, also from a people, training and process standpoint.

CPQ software in Distribution

Another example of a software that is relevant to distributors who are taking on more manufacturing activities. CPQ stands for configure-price-quote. When a customer wants to configure a product that needs a lot of detail or a system of products that need to be assembled in a specific sequence or arrangement, CPQ software can be very helpful – not just for internal teams but also for the customer.

We’ll have CPQ and MES software companies at this year’s Innovator’s Summit!

Some example industries we see CPQ gaining traction in: