In this week’s Superbowl Sunday newsletter, we take a look at traditional distributor M&A. Prices are rising to acquire distributors and more investment dollars are entering the space. Distributors have long been seen as an inflation hedge, but what else could be driving this increased interest? Is it the possibility of additional margin capture through technology and innovation? Is it an increased comfort that the Amazon effect isn’t as strong as previously contemplated? We look at the data over the past 10 years and compare.

A couple other tailwinds are presenting themselves as we start off the 2024 year. A recent report by Pitchbook and NVCA highlight the CVC, corporate venture capital, market and how it is outperforming when compared to the broader venture capital industry. We’re going to highlight some key takeaways from that report and have compiled a list of all the distributor CVC’s.

Traditional Distributor M&A is Becoming More Expensive

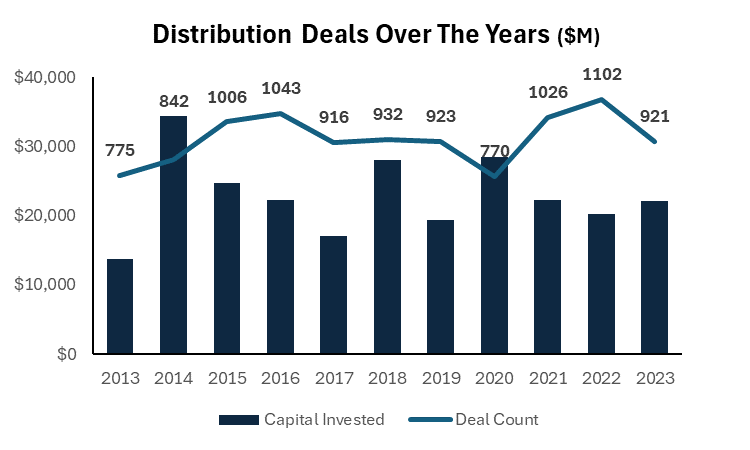

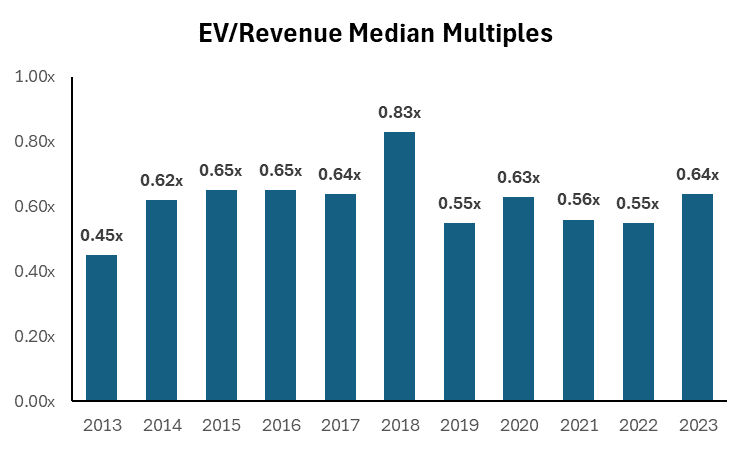

Using data from Pitchbook and other publicly available sources, we track the top few hundred distributors with over $1B in revenue. Against that cohort, we analyzed the number of distributor acquisitions, not tech acquisitions - but traditional distributor acquisitions, and total capital deployed over the past 10 years.

While deal count has fallen the past few years, total dollars invested have remained somewhat level. And, when we analyze EV/Revenue multiples, we see 2023 at a 6 year high. On EV/EBITDA, 2023 experienced a roughly 9% yoy increase from 2022.

The distribution roll-up strategy has proven to be tried and true for many PE firms over the past decade. Couple that strategy with tailwinds from technology-driven efficiency gains and you could have a pretty exciting next few years for B2B distribution M&A activity.

CVC Fund Formation Outpaces Broader VC Industry

Globally, according to Pitchbook and NVCA, new venture capital fund formations in 2023 declined by about 65% in total count of fund formations and 62% decline in total capital raised for new fund launches.

Compared to a 21% decrease in new CVC fund starts by total count of fund formations. There were 105 new CVC fund starts in 2022 and 83 in 2023.

Successor funds are a subsequent fund launch - which actually saw an increase in new fund launches. Whereas, new CVC fund launches saw a 55% decrease, which is more in line with the broader VC industry.

We saw a number of suppliers launch CVC funds in 2023 such as Coca Cola, Aramco, BP, Mars Petcare, Schneider Electric and others.

List of B2B Distributor CVC’s

Here’s our running list of B2B Distributor CVC, corporate venture capital, arms. We’ve tracked 17 different funds in 6 different verticals…