In the landscape of distributor tech investments, few stories capture the essence of the investment thesis like that of Bluon. What began as an R&D venture in 2011 has now emerged as a force in the HVAC industry initially as a B2B SaaS tool for HVAC technicians …. and now, as the leading B2B HVAC Marketplace.

This week we take an investment level deep dive into Bluon’s $7mm crowdsourced fundraise on a pre-money valuation of $107mm and how they’ve been able to bridge the gap between HVAC distributors and technicians. Our exploration will leave no stone unturned:

Bluon's revenue growth, technicians and contractors signed up, and distributors selling on the platform. 🛠

Comparison of growth to HVAC distributors’ digital efforts. 🏗

A look at business model and cost dynamics. 🍰

Is Bluon charging a SaaS fee to technicians, a take rate to distributors, or both?! 💳

New integrations Bluon is using to unlock additional procurement channels (distributors take notice!) 🌐

Why Bluon has Strategic buy-in from some of the largest players in HVAC. 🤝

Attention all enterprises seeking to navigate the landscape of tech investments, this is a rare chance to get hands-on and see just what a growth stage B2B tech startup working with distributors looks like!

The Bluon Business Model 🧊

TLDR: I like Bluon’s go-to-market. It’s aggressive and bold - and they have significant competition from other SaaS contractor tools. And, I like the crowdfunding because it allows them to receive investment by their community of HVAC technicians. Long-term, I see material downside exposure for distribution but perhaps strategic investors will be immune from these negetives.

Bluon started life as an R&D venture creating a replacement for the chemical refrigerant used in HVAC systems - this is still is a majority of their revenue today, but not for long. The company is targeting a sale of its refrigerant asset for a minimum of $15mm no later than Q1 2024. It’s a cool story but frankly not really relevant to Bluon’s current business.

After the release of its Tdx-20 refrigerant product, the company found that the HVAC industry was severely under supporting technicians in the field and created an app to be the go-to resource for technicians in the field.

Today, Bluon offers distinct software to both sides of its platform:

For technicians and contractors, Bluon’s app provides an unmatched repository of 300k+ HVAC unit manuals, parts lists by models, free tech support, and - more recently - the ability to order parts from local distributors.

On the distributor side of the transaction Bluon offers a free tool giving distributors access to bill of materials, ability to cross reference parts, match specifications, and as of the launch of BluonLive, receive price & availability requests for parts from technicians. When a distributor transacts on BluonLive, they pay a take rate to Bluon - a classical indicator of a B2B marketplace.

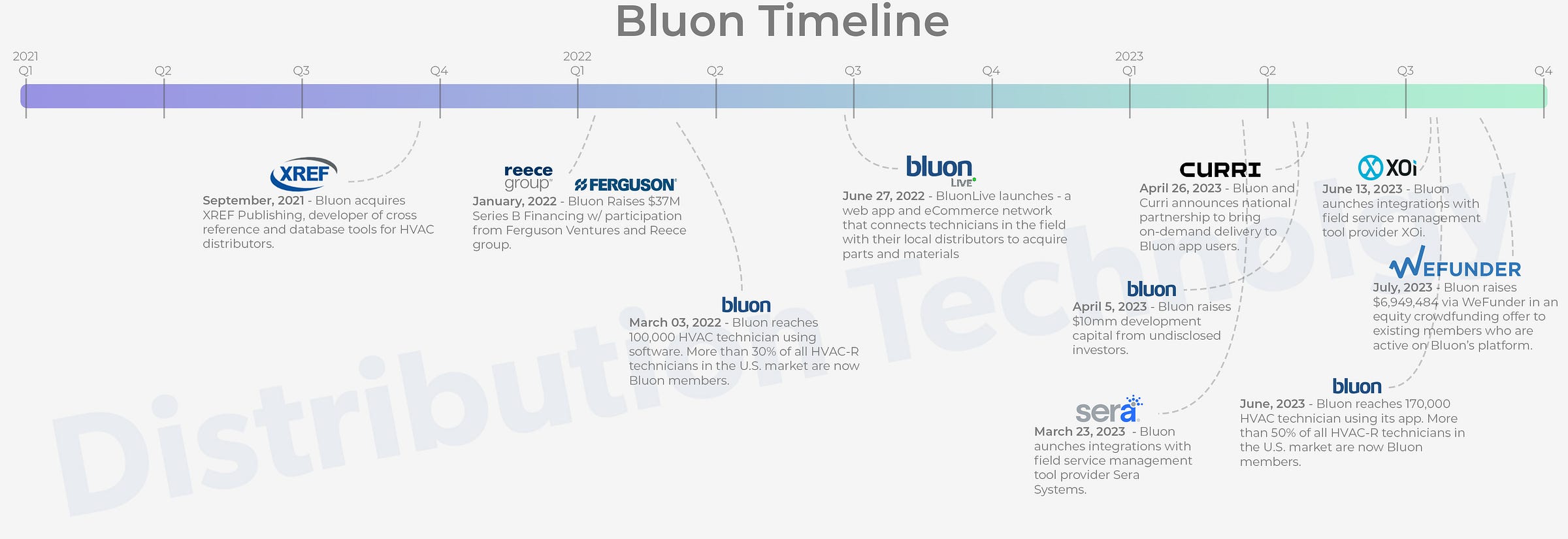

In September, 2021 Bluon acquired XREF Publishing, developer of a database software intended for heating, ventilation and air conditioning distributors to further bolster the capabilities of its software offered to distributors.

Let’s Talk Money 💵

How Bluon Monetizes:

Bluon does not charge technicians or contractors a SaaS fee for using the app and has instead opted to take a fee from distributors on the supply end of any transactions that HVAC technicians initiate through the Bluon app. This is also known as a B2B marketplace! It’s interesting that distributors would not only participate in a marketplace, but also invest in a marketplace business. One would assume that strategic distribution partners receive special terms as investors.

Based on forward looking projections in Bluon’s most recent fundraise, we estimate the take rate Bluon is charging distributors to be about 2%.

Valuation Multiples:

When Bluon raised in January ‘22, they were valued at $72mm post-money, with a little over $6mm revenue in 2021. And, most of that revenue from the sale of 1p refrigerant - exemplified by $4mm in COGS.

Then, in April ‘23, they were valued at $80mm post-money after having nearly doubled revenue to $11mm and doubling losses in ‘22. We estimate $2-3mm of actual “take rate” revenue - the kind of revenue that investors place a high premium on.

A few months later in July ‘23, their crowdsourced fundraise puts Bluon at $114mm post-money.

Growth of GMV:

Their written disclosures detail heavy customer concentration and that strategic investors, via undisclosed side letters, may receive discounts and preferential treatment on paying fees. Applico’s estimate is that Bluon has built a ~$250mm GMV business, on the backs of a couple anchor HVAC distributor strategic investors who don’t pay take rates.

Growing to over $200mm GMV in less than 2 years is impressive - highly valuable if Bluon can control its costs. And, very scary for HVAC distribution…

Bluon’s 75% YoY Revenue Growth 📈

But, double the losses…

As you see in Bluon’s P&L below, they more than doubled their sales and marketing expenses, but only had a 75% revenue increase. That said, HVAC user growth is a better KPI to analyze compared to sales and marketing spend - Bluon added about 55,000 users in 2021 and then at least 70,000 users in 2022. On a relative basis, they spent about $50/user in ‘21 and $80/user in ‘22. They are clearly betting that - over time - these HVAC technicians will procure more and more of their parts through Bluon.