Applico Capital Announces Tech-Enabled Private Equity in B2B Distribution

Empowering B2B Distributors to Grow Faster and More Profitably with AI

Hi everyone,

This past week was a big week.

There were multiple announcements reflecting the growing impact that AI will have – not only on B2B distribution but also how all businesses will operate writ large.

And, it makes sense when you see innovations like Elon’s Neuralink enabling blind people to see again.

If Neuralink can make blind people see again by plugging into a human’s brain and connecting you to robot eyes … can we help distributor sales reps quote better?!

A few people certainly seem to think so, ourselves included…

Three Tech-Enabled Private Equity Announcements All on the Same Day

Applico Capital, QXO/Beacon, and Josh Kushner’s Thrive all made big announcements this past Tuesday, April 29th.

Applico Capital announced our tech-enabled private equity strategy for large B2B distributors. More on that below.

Brad Jacobs’ QXO officially closed on their $11B acquisition of Beacon. And, they shared on an analyst call some additional thinking on their thesis and how they justified the premium they paid. DSG did a great job summarizing the release – much of it focused on how AI will enable QXO to unlock material synergies inside of Beacon. As we’ve covered previously, QXO hired Target’s head of AI to join them and build the AI team at Beacon.

Here are a few of the stand-out quotations from Brad Jacobs:

“This is day one of building the first great tech-enabled building products distribution company,” Jacobs said. “We’re going to introduce software that empowers our team and our customers. That’s how we win margin and loyalty.”

“We’re going to grow through acquisitions, yes, but also by being the best operator in the industry,” Jacobs said. “We’ll do it smarter, faster, and with better tools.”

Last, but not least, Josh Kushner’s Thrive announced a tech-enabled private equity fund for AI-powered roll ups. They are going to buy companies and then optimize with AI. They identified accounting firms as an example industry that they would focus on with this strategy.

Applico Capital’s Tech-Enabled Private Equity Strategy in B2B Distribution

We were excited to finally announce this week the launch of our new thesis and the creation of the new division in Applico Capital: tech-enabled private equity.

As many of you know, we launched our venture capital fund in 2023 – the first, and only, venture capital fund focused on technology investments that help B2B distributors. Over the past decade, we’ve operated at the intersection of technology innovation and digital transformation with large B2B distributors. The next few years are going to be, without a doubt, the most exciting for this industry. What we’ve seen AI do in the past couple years wearing our venture capital hat is truly phenomenal – and the pace that AI effectiveness is accelerating is unprecedented.

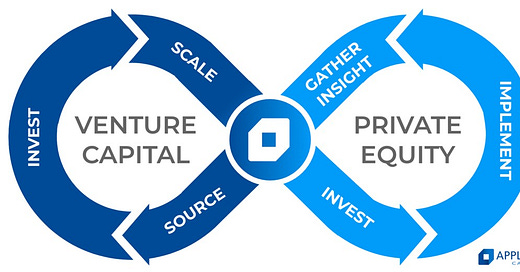

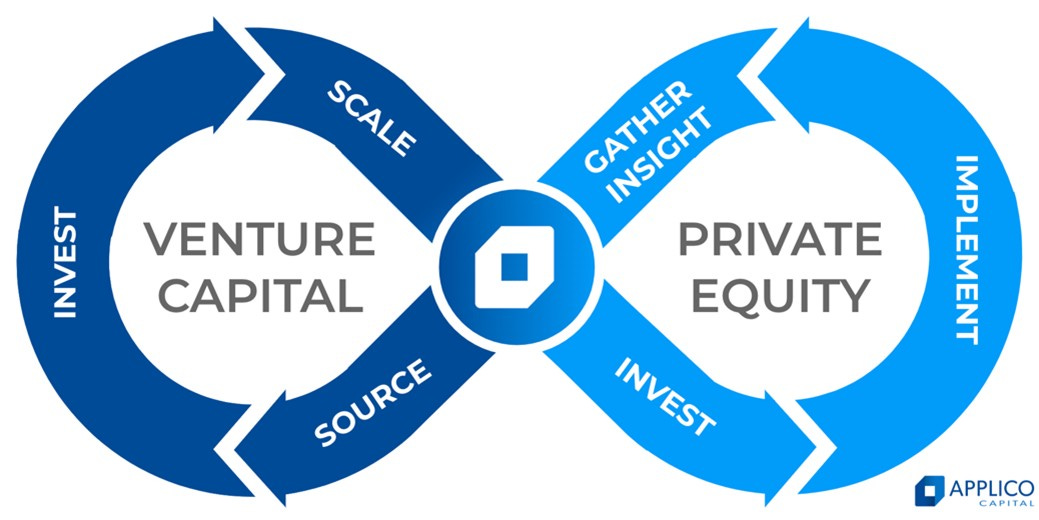

The launch of this tech-enabled PE strategy is a natural evolution for Applico Capital because it’s effectively the same thing we’ve been doing for the past decade: helping large distributors adopt new technologies. And, it’s synergistic with our venture strategy, which is also focused on the same goal but deploys capital towards that objective differently: investing in the tech startup as opposed to the large distributor.

These two investment strategies, venture and private equity, create a powerful feedback loop with one another. Insights from venture investments and the startup landscape inform private equity synergies. And, the needs from private equity inform venture’s focus.

We’re hiring!

Are you working in B2B distribution and interested in AI, machine learning, data, and technology innovation? Contact us!