Amazon Q1 Earnings: Profits Triple from a Year Ago

Officially enters “Cash Cow” status. Breakdown & analysis.

It’s the beginning of earnings season and Amazon likes to get out ahead of the pack, announcing their Q1 earnings on April 30th this past week. Our three takeaways?

1. Amazon’s monopoly is strong, optimizing for profit in the face of slowing growth.

2. Third-party sellers are suffering as a result.

3. GMV growth is slowing.

Look at these profits! Amazon: the Cash Cow Monopoly.

I thought inflation and interest rates were hurting the consumer. You wouldn’t know it looking at these graphs. But, why are profits growing so quickly? Because of consumer spending or Amazon gaining market share? Or, are these figures derived from Amazon unfairly extracting value from its third-party sellers and vendor “partners”?

Marketplace adds $4B operating income on $10B revenue growth

Yes, you read that correctly. It doesn’t make sense, right? Correct – it shouldn’t make sense … for any normal business. But, Amazon isn’t normal, it’s a monopoly.

These numbers just reflect Amazon’s marketplace business in North America, not AWS which is separate. Net sales are up 12% YoY and Operating Income spiked 455% YoY to almost $5B.

However, Amazon hasn’t released GMV (gross merchandise value) numbers. Amazon’s revenue, their net sales, doesn’t represent the total amount of purchases through its product marketplace. Net sales is derived from a take rate, fulfillment fees charged to third-party sellers, advertising revenue, as well as Amazon’s first-party sales revenue (i.e., Amazon selling their own products).

Marketplace GMV grew less than 10% YoY.

To be clear, Amazon hasn’t released their GMV figures. This is purely Applico’s assumption. Here’s why we think this is the case…

Amazon’s biggest profit driver in its marketplace are the fees they charge third-party sellers. This is take rate revenue, fees for fulfillment, and more recently: advertising.

A recent report highlights that:

Amazon is taking 45 cents on every dollar from its third-party sellers.

That’s highway robbery! For example, if you’re a third-party seller and you sell a product for $10 on Amazon, that means Amazon takes $4.50 and the seller keeps $5.50. They’ve captured 45% by steadily increasing their take rate as well as fulfillment fees to the seller. And, in particular, the introduction of advertising. For a seller to stay relevant on Amazon, they have to buy ads. Otherwise, their product listing will never be seen. Remind you of another tech monopoly? Try doing a Google search these days – it’s flooded with ads.

Grainger Q1 Sales up ~4-10% YoY

As a point of comparison, although not apples to apples, Grainger had roughly 50% the quarterly YoY Growth that Amazon had. You’d think Amazon would need to have much more growth than that to properly justify the increase in profits they captured. But, once a monopoly has achieved critical mass, it doesn’t have to provide top-line growth to capture increased profits. This is the definition of being in the “cash cow” stage.

Grainger reported on April 25th and despite missing on both revenue and EPS guidance, their QoQ sales were up 3.7% to 10% depending on how you measure the growth. Zoro, their marketplace, had 5.1% YoY sales growth.

It would seem that Amazon and Grainger have similar quarterly, YoY growth in product sales; yet Amazon has much more leverage to extract fees from their third party sellers.

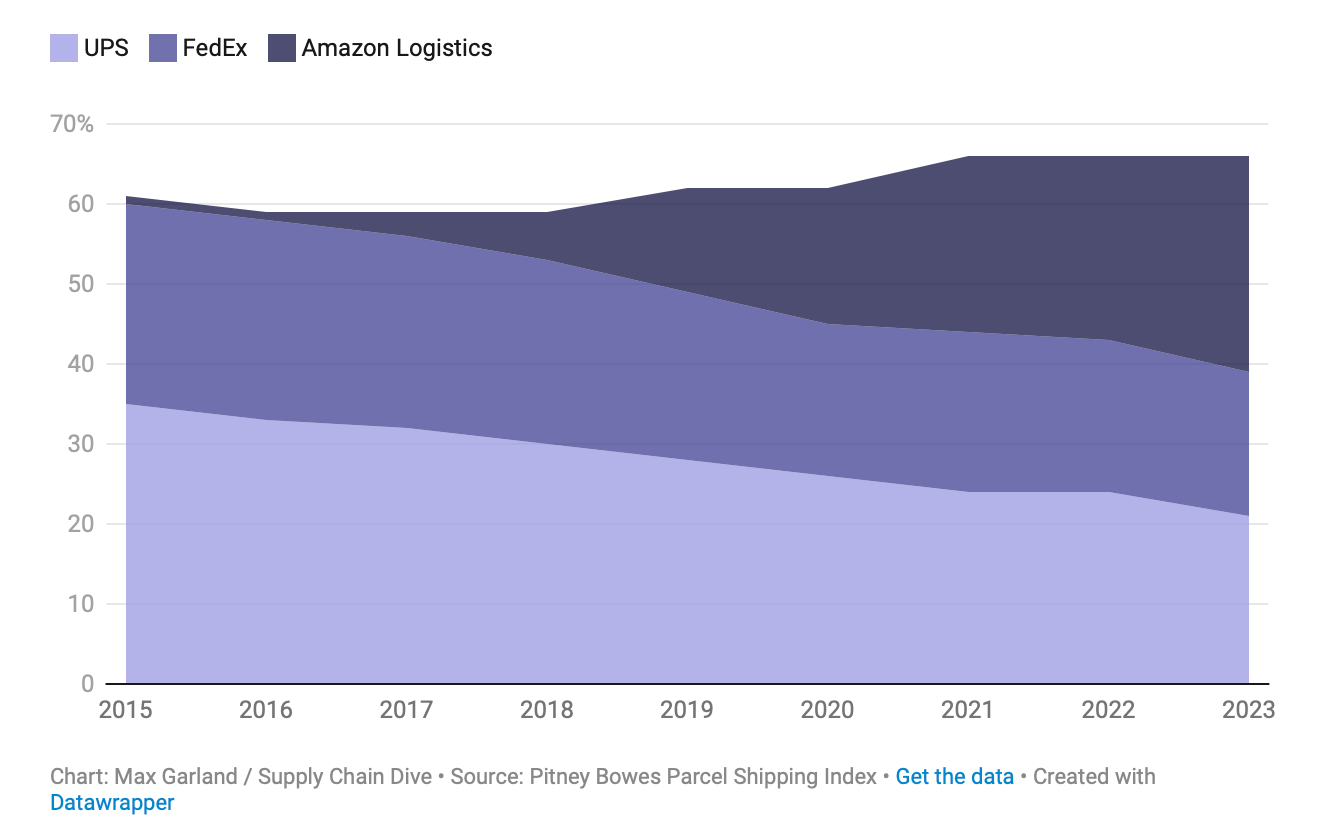

Amazon Eclipses UPS in Parcel Volumes

The other parties we see being squeezed out of the picture are FedEx and UPS. FedEx boldly decided to end their commercial relationship with Amazon a few years ago – recognizing that doing business with Amazon was making a deal with the devil. Amazon is a direct, competitive threat. And, now, as the largest private parcel delivery company in the country, Amazon arguably has the lowest cost to serve the customer.

In Amazon’s Q1 earnings report they cite, “With more than 2 billion global units arriving the same or next day in Q1, Amazon delivered to Prime members at its fastest speeds ever. In March, across the top 60 largest U.S. metro areas, nearly 60% of Prime member orders arrived the same or next day”. The moat from Amazon’s fulfillment capabilities is palpable.

Risk of China Exposure: Rise of Temu and Shein

We’ve written previously about Amazon’s over-exposure to Chinese sellers. Since then, that dependency has only increased.

The growth in this graph is reflective of a crack in Amazon’s armor: China – and our US government is asleep at the wheel (shocker!).

Temu and Shein, two competitor marketplaces offering US consumers the ability to buy “direct from the Chinese manufacturer,” are growing quickly with many billions of dollars in sales. You may recall seeing more than a few of their Superbowl commercials this past year.

Temu and Shein are investing in their own warehouse and fulfillment capabilities on US soil and also benefiting from tax loopholes. I’ve also heard that Chinese companies ship materials to Mexico – then ship from Mexico to the US to avoid import taxes. So, the data looks like Mexico is our largest trading partner … but is it really? No!

Amazon Business Buys a B2B Distributor?

With precedent from the Home Depot & SRS deal, would Amazon buy a B2B Distributor to accelerate Amazon Business’ growth? It’s more than plausible.